I have a few batch of updates to provide for you all, let’s get right to it with the first three:

Bragg Gaming Group (NASDAQ:BRAG) Update

Bragg reported Q1 2025 results on May 15th. Here is the link to my initial pitch for those who haven't read it.

The capital structure is as follow:

The company reported solid results, but slightly lower than consensus. Betcity/Netherlands explains the miss, which I will discuss in more detail later.

Revenue was +7.1% YoY and EBITDA +19.7% YoY. On a sequential basis, revenue declined by 3%, excluding the impact of Betcity/Netherlands, and better than typical seasonality seen in iGaming:

USA revenue grew 61% QoQ and 338% YoY!! More importantly, EBITDA grew close to 20% YoY, while capex only grew 7% YoY. This is thanks to proprietary content, which grew 9% QoQ and 62% YoY. This is extremely important as the main historical pushback (besides their significant revenue concentration to a single customer) has been the lack of FCF generation. I believe the business is now at an inflection point, and we should see consistent improvement in FCF conversion metrics; management is slowly showing the scalability of the model.

Betcity continues to weigh on overall topline growth. The customer is now 16.5% of revenue versus 26.9% last year in Q1. It declined 14% QoQ after declining 15% QoQ in Q4. This is all driven by the regulatory changes in the Netherlands which have weighed on results. However, the added disclosure around the contract clearly shows that Betcity contributes a lot less to EBITDA:

Using some of the metrics provided on the presentation and using the commentary around gross margin on the call, it’s easy to see that while Betcity contributes 16.5% of revenue, it likely contributes less than 7% of EBITDA. And even if Betcity were to drop Bragg at the end of 2026 (It’s almost impossible for them to drop them at the end of 2025), by that point, Betcity would be immaterial, and most of the 3rd party aggregated content would stick. Finally, it’s worth remembering that Bragg has a leadership position in the Netherlands with 30%+ market share. If BetCity were to migrate away from Bragg, I would expect significant customer churn in the near term, which Bragg’s other customers would capitalize on. But again, Betcity is simply not an issue anymore.

Finally, I know there are some concerns about the achievability of the revenue guidance management has set. While the 120.25m revenue guidance implies very aggressive sequential growth, I don’t think it matters much. Why? Because the company is clearly showing they can grow double-digit profitably while shedding low-margin revenue (Betcity). The mid-point EBITDA guidance seems completely intact, even if they come at the bottom end of the revenue range. It’s important not to lose sight of the bigger picture:

Bragg is expanding its EBITDA margin at 150-200 bps a year, with a clear sight to 30%+ EBITDA margins. The business is growing at a healthy clip, actively reducing customer concentration, and has significant operating momentum and industry tailwinds (iGaming is growing 20% YoY + new Jurisdictions are coming). Betcity is becoming less meaningful, revenue is shifting to higher-growth/higher-margin areas (USA, Brazil, proprietary content), and paid down debt with a credit facility on its way for flexibility. It’s becoming a much healthier business, making it easy to underwrite a much higher multiple for the stock. Meanwhile, while they remain capital constrained, they are finding creative ways to unlock optionality like the RapidPlay investment within Brazil.

And if you are unable to assess how good their products are (which, from my work, is seen as best in class), just look at all the nominations the company has received over the last few weeks: At SBC, one of the biggest gambling awards:

Game Aggregator of the Year

Game Mechanic/Feature of the Year

Socially Responsible Initiative of the Year

Employer of the Year

At EGR, another well-recognised event, they were shortlisted for nine categories:

Slot Supplier of the Year

Casino Software Supplier of the Year

Full Service Platform of the Year

Aggregator Platform of the Year

AI Solutions Supplier of the Year

Employer of the Year

Safer Gambling Software Supplier of the Year

Innovation in Mobile

Innovation in RNG Casino Software

I’ve tweaked my model a bit and reduced my revenue growth to 15% this year (instead of 17%), but I have kept EBITDA intact:

Since my March update, a couple of tailwinds have popped up: Ohio just rolled out an iGaming bill that is very likely to pass. Alberta has approved iGaming, which is set to launch in early 2026. Management won two new customers: Bet365 in Mexico and Casino Times in Ontario.

Bragg remains my highest conviction idea and I believe management can reach $50m+ of EBITDA over the long-term which would allow me to underwrite a $20+ stock

Danaos Corp. (NYSE:DAC) Update

Danaos reported Q1 2025 results on May 13th. Here is the link to my initial pitch for those who haven't read it.

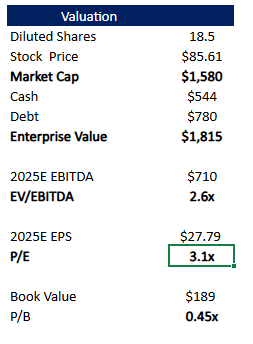

As a reminder, the cap structure is as follow:

The stock trades at 3.1x EPS, 0.45x book value while actively buying back stock. In Q1, the company bought $33.7m worth of stock, and another $19.4m post-quarter for 264.6K shares.

Management continues to completely de-risk the story: Contracted revenue is basically secured for all of 2026 and with the recent strength in the shipping industry due to the tariff pause, I wouldn’t be surprised if management further de-risks 2027:

Effectively, Danaos has over $3,700m in contracted backlog at a 70% EBITDA margin or $2,590m in value, with a remaining average contracted charter duration of 4 years. You are basically buying the existing backlog and getting everything else (hard assets & future earnings) for free. As a reminder, even if rates were to collapse, the company is still on track to earn well over $17.62 of EPS:

But I think this scenario is less and less likely. At this point, with all the new 15 ships coming late 2027 and into 2028, I believe Danaos, through buybacks, can effectively continue to earn $27-28 up until 2032 and potentially beyond.

Many have an aversion to shipping stocks, especially given the industry collapse from 2008 to 2020. But similar to other cyclical leasing companies like aircraft lessors, or equipment lessors, if the company can manage its maturities properly, such that earnings volatility during turbulent times can be reduced. If that were to happen, then one could ascribe a multiple derived from its ROE, which would be well over 6x EPS. It gets pretty easy to underwrite a stock worth well over $200. As a reminder, Atlas Corp, which was a publicly traded containership lessor, was acquired for 9x EPS. Atlas had longer-term contracts (8-9 year remaining maturity), and was levered but it still gives you a sense of the potential upside.

While you wait for the stock to re-rate, you are receiving a 4% dividend yield, share count continues to decline, and cash builds. Management has consistently increased the dividend since fixing its balance sheet in 2021. I would expect them to bump their dividend to $1/share/quarter in November.

I continue to hold the position and remain very bullish on the stock.

Quipt Home Medical (NASDAQ:QIPT)

Quipt reported Q2 FY 2025 Results on May 12. Here is the link to my initial pitch for those who haven’t read it. I have exited my position, and will walk you through my rationale.

My investment thesis was primarily anchored on two specific outcomes. First, that activism leads to the announcement of a strategic review. This was proven wrong in late March when management agreed to a standstill with both activists but released a press release outlining strategic priorities that did not hint at a business sale. Second, that the company’s KPIs would continue to improve. However, this quarter demonstrated the opposite:

Patients served took a meaningful step down, and while some of it is attributable to seasonality, the drop was steeper than expected. And while management is doing a good job holding the margins and improving cash flow over the last two quarters, revenue growth is simply anemic:

Management reported their Q1 results in February. They had spoken of improving trends and were confident in returning to normalized growth of 2% QoQ over time. But now, they mention that the weakness they’ve seen in January and February reversed in March and April. This means that management was aware of the existing weakness when they signed the standstill agreement and reported Q1, but decided to misdirect investors, likely to win the proxy fight and appease the activists. It's hard to get behind that. While I still believe the asset would be perfect for a PE looking to set up a home medical equipment platform, I can’t solely rely on that as an investment thesis.

I’ve overstayed my welcome on the stock, but I’m now happy to move on.

Disclaimer: I am long NASDAQ:BRAG, & NYSE:DAC. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time

QIPT: now what? Jumped back in?