Quick Pitch: Marcus Corp. (NYSE:MCS)

Significant upside to near-term estimates, 90% of its market cap covered by real estate at cost, actively buying back stock and catch-up trade to lower-quality peers

Quick Summary

Undervalued Real Estate which covers 90% of its market cap

MCS Trades at a material discount to its peers despite a solid track record of capital discipline & shareholder Return

Management is aggressively buying back stock

I see 60% upside driven by clear near-term Box Office catalysts, 20-30% upside to near-term estimates, and strong recovery over the next 2-3 years

Capex cycle normalizing, setting up for improved free cash flow generation.

Very Brief Company Overview

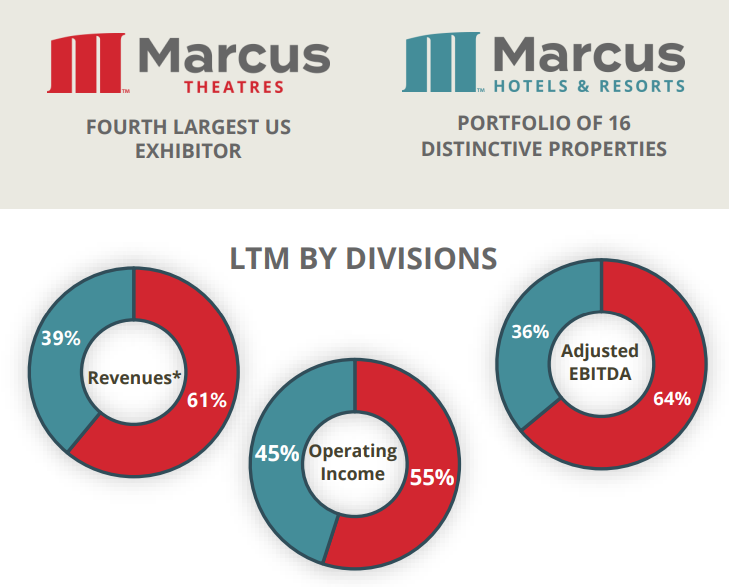

Marcus Corp. operates two distinct businesses: Marcus Theatre, the 4th biggest exhibitor in the United States, and Marcus Hotel & Resorts, a collection of owned hotels and managed hotels for leading brands. The financial breakdown is as follows:

My quick pitch will revolve primarily around the theatres business, which has multiple imminent catalysts in the near and medium-term.

The Longer-Term Box Office Recovery

I won’t spend too much time explaining the theatre industry. A friend of mine, Raging Bull Investments, has written a multi-part deep dive on the space, which provides a better understanding of the industry's structure. Give him a follow! For now, I want to focus on a few key points:

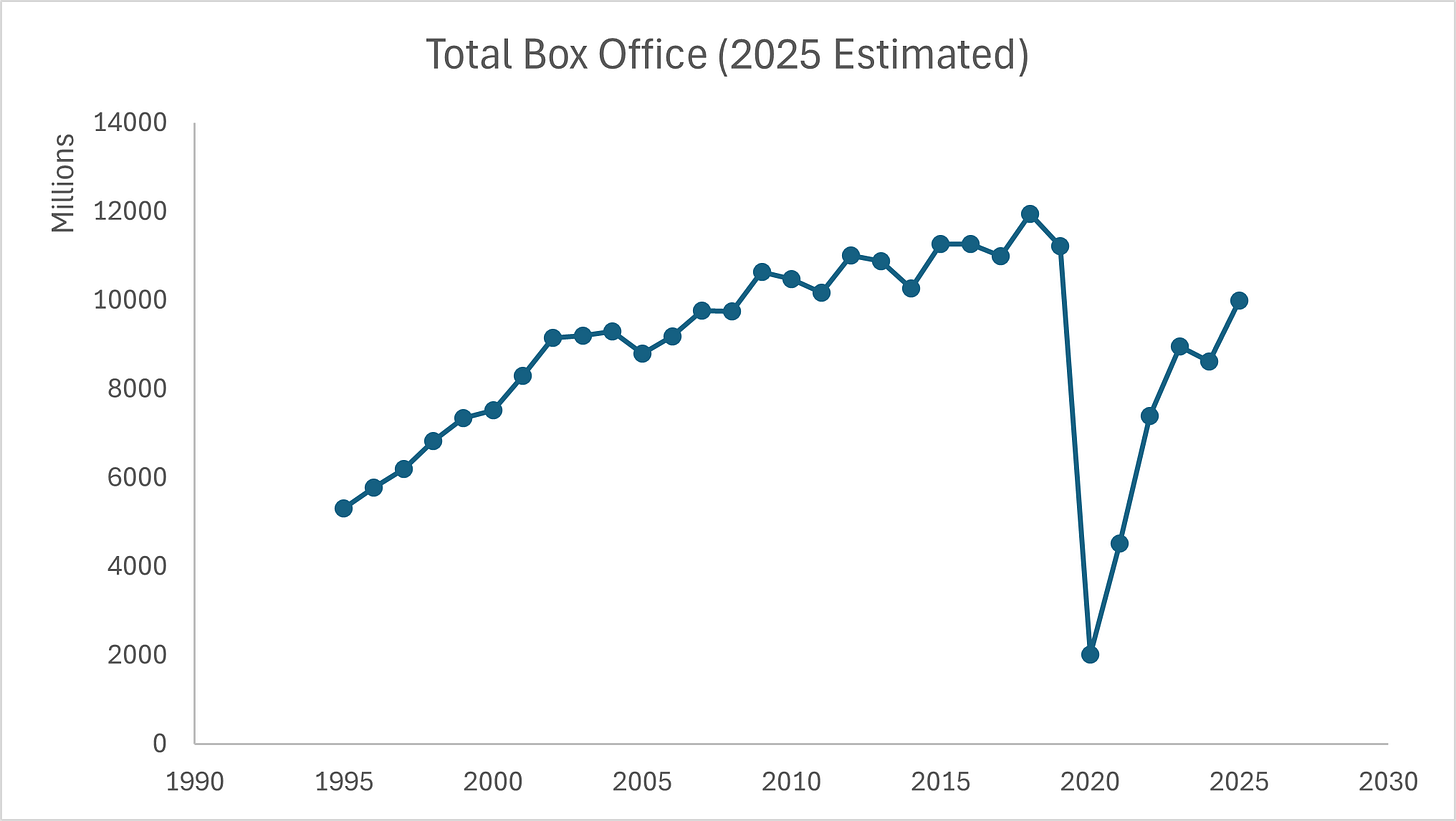

The Box Office is on a clear recovery path, with 2025 estimated to break through $10b this year finally. See the chart below:

The recovery is driven by a few factors:

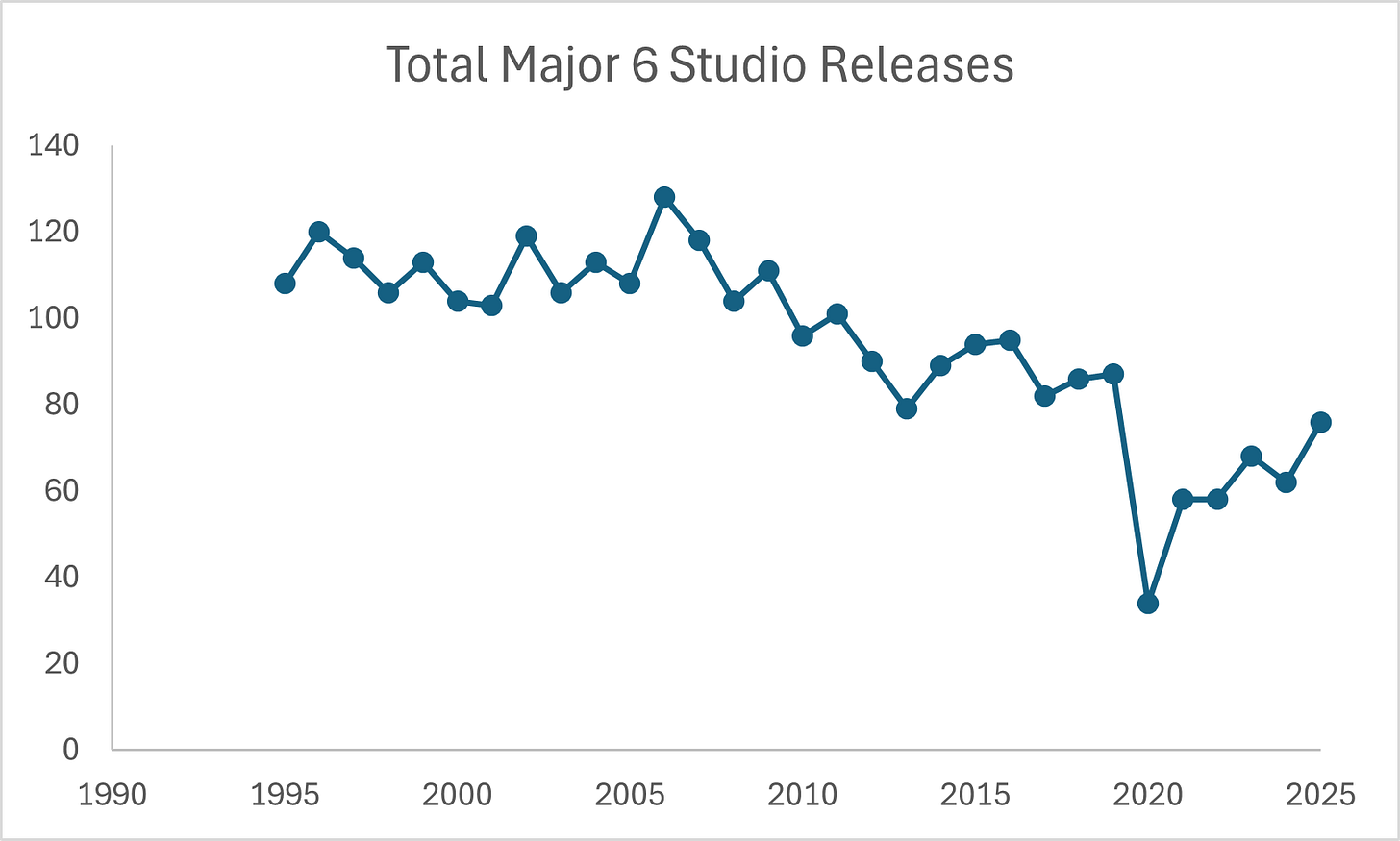

The recovery of movie supply is gradually being driven by the six major studios as they re-engage with the box office. This has been especially true over the past 12 months, as several films originally planned for streaming-only releases (Moana 2, Lilo & Stitch, Alien: Romulus, Smile, and Mean Girls) became significant successes for the studios at the box office:

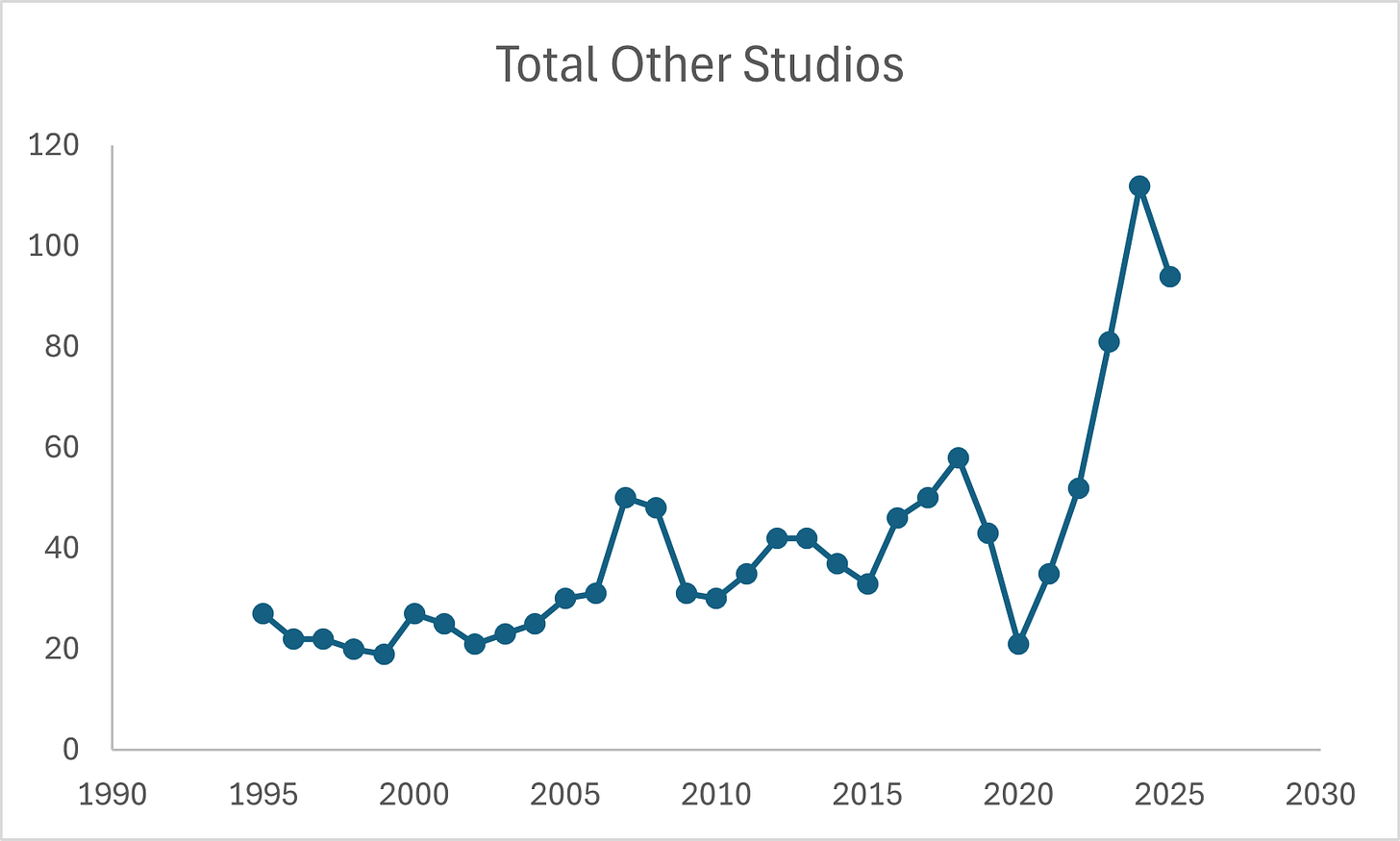

The growth of alternative studios, especially among the major streaming companies, was initially seen as a direct competition but is now increasingly viewed as complementary to the theater industry. This includes Amazon, which has committed to 14 wide releases per year; Apple, which has pledged $1 billion annually for films in theaters; and even Netflix, which is gradually relaxing its rules regarding theaters. Below is a chart showing the number of movie releases from other studios: while the total is significantly higher, it’s important to note that most are not wide releases.

The industry was heavily impacted by the 2023 writers' and actors’ strike, which has affected movie supply and recovery in 2023 and 2024. However, this is setting up the industry for a massive 2025, 2026, and 2027.

For 2026, we have Avengers: Doomsdays, The Mandalorian, Fast X, Dune:Messiah, Toy Story 5, Shrek 5, Spider-Man, Moana Live Action, Ice Ag 6, and Super Mario Bros 2. For 2027

For 2027, we have Avengers: Secret Wars, Lord of the Rings: Hunt for Gollum, Frozen 3, Sonic 4, Batman Part 2, How to Train Your Dragon Part 2, Legend of Zelda, Spider-Man: Beyond the Spider-Verse and another Star Wars movie.

2025: A key Catalyst for the Equity

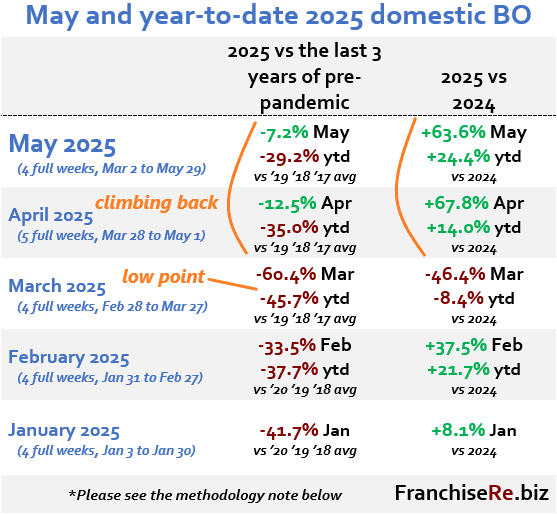

For now, MCS is set to have a very strong 2025 driven by a box office that is significantly outperforming expectations with YTD +24%, and Q2-to-date up over 60% YoY:

At these levels, Marcus should be printing cash, and the remainder of Q2 and Q3 are set to be very strong as well, with How to Train Your Dragon live-action set to surpass all prior movies. F1, Superman, 28 years later, and Fantastic Four all tracking very strong according to presale data.

Marcus generated $155.2m in EBITDA in 2019. I would not be surprised if the business approaches $130m this year (vs $108m estimates) and potentially reaches its prior high in 2026, should the Hotel segment remain consistent.

Hidden Real Estate Value

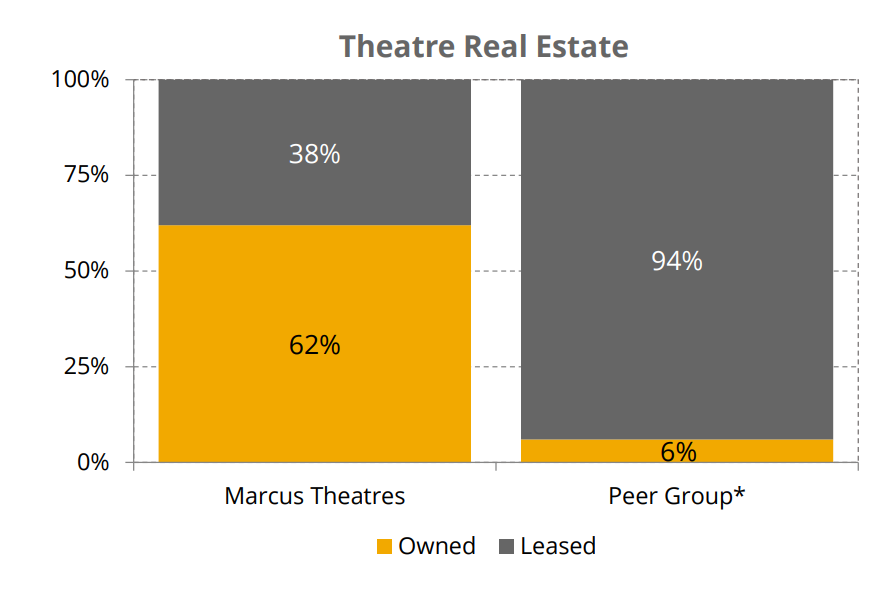

Unlike its competitors, Marcus owns the majority of its real estate within its theatre segment, and 7 hotels within its hotel segment.

Today, its real estate is valued at cost within its balance sheet, and given its long history of operation (Marcus Corp was created in 1935) I wouldn’t be surprised if a good chunk of it is carried for peanuts. According to the latest 10-Q filing, the company’s net property and equipment value is $693 million, or $22 per share. Assuming all of the debt (approximately $200m) is tacked on to the real estate (and not the operations), the company would still have an equivalent of $15.65/share in net properties AT COST. MCS trades today at $17.66. Effectively, close to 90% of its market cap is covered by its Real Estate at cost, alone.

While unconfirmed, I’ve heard rumors that the Grand Geneva Resort & Spa, their best asset, is worth over $100 million on its own.

Alright, alright, I am sure the skeptics here will argue that the value of the real estate will never be crystallized, and that management will never monetize any assets. I do not believe this is true, which I will discuss in my next section.

Clear History of Divestitures, Capital Return & Smart Capital Allocation

Despite being Family-owned, Marcus has proven to be fairly shareholder-friendly over the years, and I am not talking about dividends only:

In 2006, at the peak of the US Real Estate bubble, MCS divested its budget lodging assets and issued a $7 special dividend to its shareholders. At the time the stock price was a little under $22

In 2012, while its stock remained depressed at around $12, management bought back close to 7% of its shares outstanding and declared a special dividend a year later

The company had increased its dividend at over a 12% CAGR between 2013-2019

In late 2022, the company divested its Skirvin Hilton Hotel for $36.75m at 13.6x 2019’s EBITDA and 19.7x LTM EBITDA, while MCS traded at 6x EBITDA

During the pandemic, management took on convertible debt. As soon as they were able to redeem it, they called it in cash and immediately started buying back shares, repurchasing $10m in 2024 and another $7.6m in Q1 2025

Management recently reinstated its dividend and is paying its common shareholders 10% more than the Class B shares owned by the family

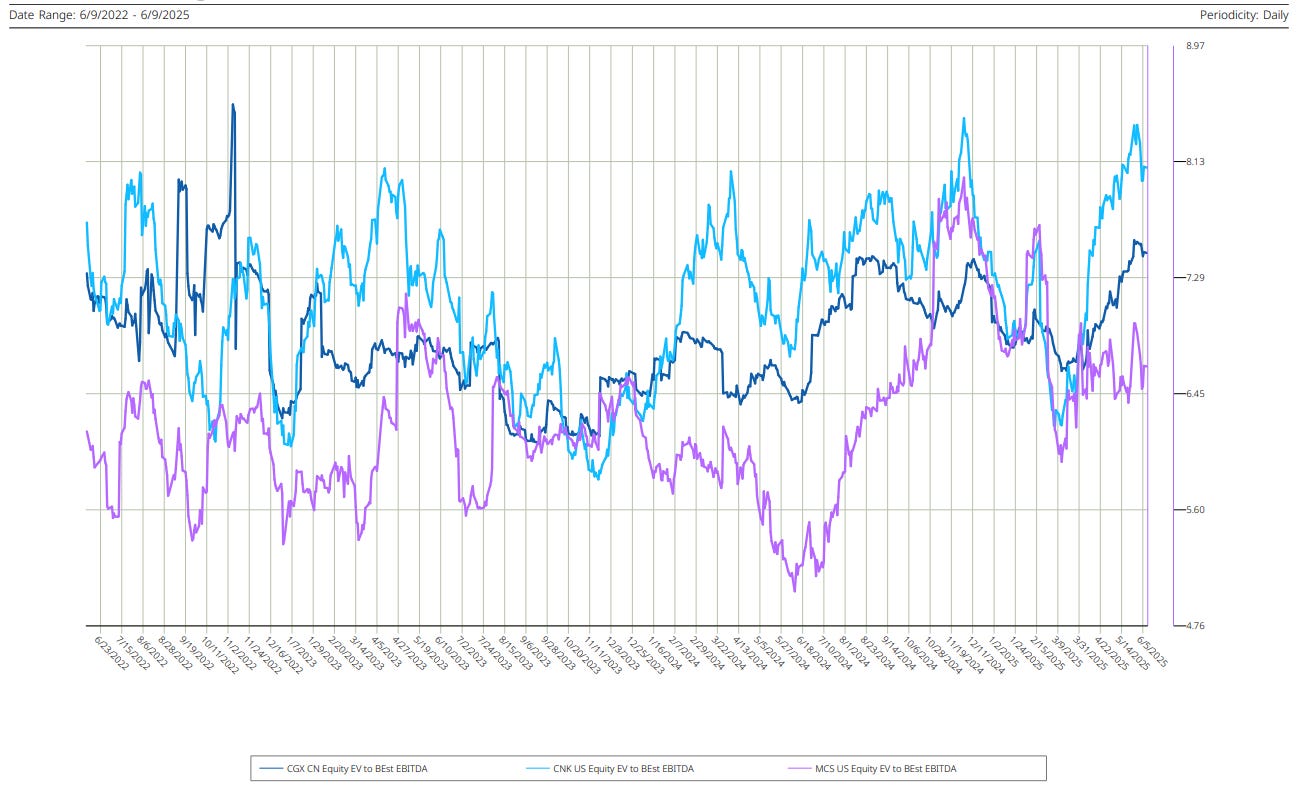

It’s worth noting that despite being the most shareholder-friendly in the space, and the least levered, with a hotel business that should trade at a meaningful premium (most hotel REITs trade at 10x+ EBITDA), MCS trades at a steep discount to competitors, which makes no sense:

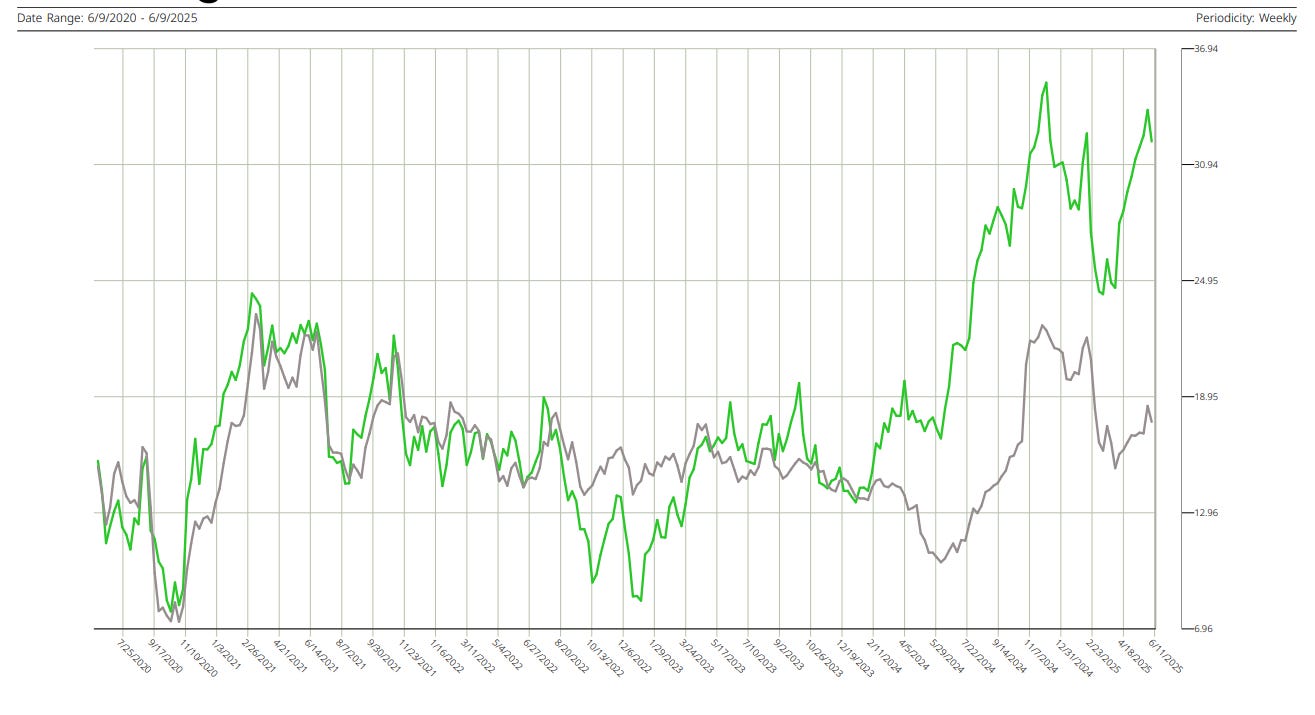

Usually, the discount does not last, and betting on a catch-up trade has proven to be lucrative in the past:

I believe MCS should slowly close the discount to both Cineplex (CGX) and CNK (Cinemark) in the near-future.

Valuation & Last Key Points

My valuation is pretty straightforward:

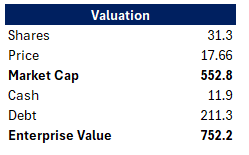

Assuming the company returns to $155m of EBITDA in 2026, using 7x EBITDA, the stock should be worth $28 or close to 60% upside from current trading levels ($17.66).

Also worth noting that the company’s FCF burn is back-weighted. Assuming they can generate $30m of FCF this year (despite $80m in capex) that means over 50m of FCF will accrete to the EV over the next 3 quarters, or 10% upside alone. For 2026, at $155m of EBITDA, I would expect the company to generate 65-70m in FCF, or 13% FCF yield for a business that owns most of its real estate.

Risks

Potential perception of secular challenges at the Box Office

Hotel business is more economically tied, but as of May, management stated that its bookings are tracking ahead of 2024 levels DESPITE facing difficult comparison from the Republican National Convention in Milwaukee. Also worth noting that Cinemas have historically been resilient during economic downturns, and this has proven true in recent months

Over the last two years, MCS has gone through a period of significant capital investments driven by deferrals in its hotel business during the pandemic. Last year, the company spent $79m in capex and is set to spend another $80m this year. However, we are at the tail-end of the cycle, and capex should normalize at $50m, setting the stage for meaningful FCF

Disclaimer: I am long NYSE:MCS. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

Dont usually play with real-estate stocks but great post

A spin off of the hotel business could benefit shareholders and stock appreciation to close the discount to CNK and CGX.