Quick Pitch: Gambling.com Group (NASDAQ:GAMB)

94% Gross Margin, 24% Net Income margin with 20%+ ROE business and a solid balance sheet, trading at 10x EPS next year's EPS, growing double-digit organically, and actively buying back stock

Summary

94% Gross Margin, 38% EBITDA margin, 24% net income margin, and 25% ROE business trading at 10x 2026’s EPS growing double-digit

Significant industry tailwinds support double-digit organic growth for the foreseeable future

Management team with significant stock ownership that has proven to be shrewd capital allocators

Company Overview

Gambling.com is a performance marketing company that operates gambling-related websites, allowing online gaming operators, such as FanDuel, Bet365, and DraftKings, to acquire depositing customers. Its main websites include Gambling.com, Bookies.com, Casinos.com, RotoWire.com, as well as over 60+ local websites.

The business model is similar to that of other publicly traded affiliate marketing companies, such as QuinStreet (Insurance.com) or LendingTree.

Revenue is monetized in three ways:

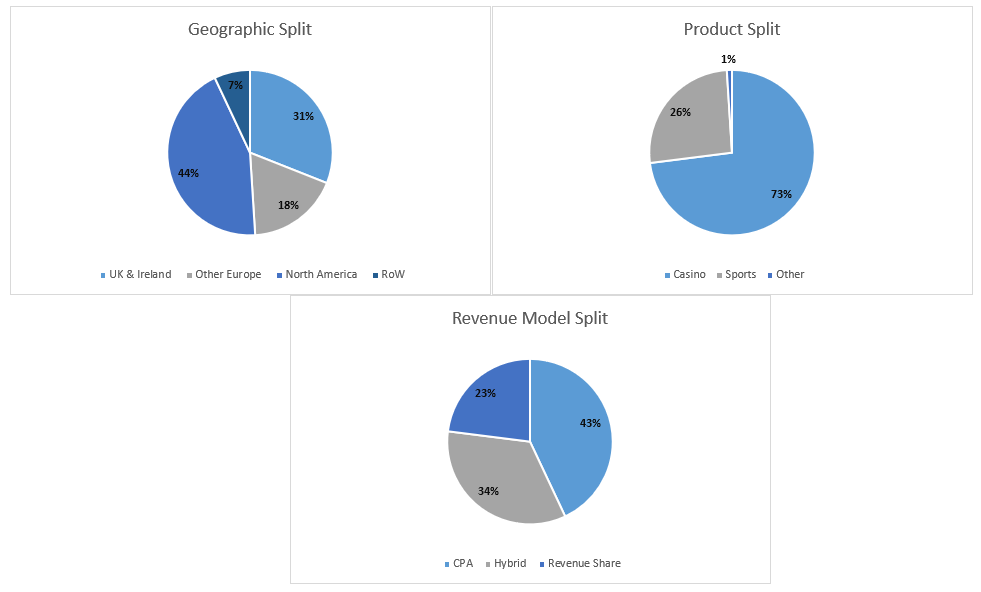

Cost per Acquisition (CPA) revenue, which represents 50% of net revenue, is earned through a fixed fee model for each user it refers to an operator who subsequently registers and makes a deposit.

Revenue Share fees represent 15% of revenue, and Gambling.com earns a percentage of the net revenue generated by the referred users over a specified period or for the user's lifetime.

Hybrid model fees account for 35% of revenue and combine the two previously mentioned revenue streams.

Gambling.com primarily focuses on referring customers to online casino products. 62% of its revenue is generated through iGaming and social casino products, while the vast majority of the remainder comes from sports betting products. 48% of its revenue is derived from Europe, 44% from North America, and the rest of the world accounts for 8%.

GAMB’s business model is extremely attractive, boasting a 94% gross margin, a 38% EBITDA margin, a 30% net income, and an FCF conversion rate of nearly 100% of net income. Despite that, the company continues to trade under 9x EPS and 5.5x EBITDA, driven by multiple headwinds which I believe management is actively addressing:

A bit of History

Gambling.com Group was founded in 2006 by Charles Gillespie (Current CEO) and Kevin McCrystle (Current COO). Following a few years of exponential revenue growth (2017-2022, 49% CAGR), driven by domain expansion & new market legalization, the company saw its growth impacted by Google changes both in 2023 and early 2024:

At the end of 2023, Google rolled out some updates to its platform that affected GAMB’s SEO performance in the UK & Ireland for its core business. At the same time, the company started to invest in media partnerships by offering sports and casino content in a digital newspaper in exchange for traffic to GAMB’s site. However, Google changed how it handled commercial content on high-authority sites in early 2024, making these media partnerships less effective and forcing management to lower their expectations. The stock price fell from a peak of $15 to below $8 in June 2024. To be conservative, management zeroed media partnership revenue in their guidance and accelerated growth in their own websites, which led to a Q2 beat and raise. Below is a chart that provides further context:

Following the Q1 2024 Google Media partnership impact, which forced them to reduce guidance, the business went on to report record results for Q2, Q3, and Q4 2024.

Consistent Market Tailwinds Ahead

GAMB is a beneficiary of iGaming legalization, which is set to grow 12% CAGR globally and 28% CAGR in the US through 2030.

Only seven states have legalized online casinos: New Jersey, Delaware, West Virginia, Pennsylvania, Michigan, Connecticut, and Rhode Island. Every year, several states try to introduce bills to legalize iGaming. While most of them don’t make it, only one bill every two years needs to pass for companies to experience huge growth. In 2025, ten states put forward bills to legalize online casinos. Most have failed this year, but what’s going to happen when states need more tax revenue and the online casino floodgates open? GAMB’s earnings could skyrocket, easily creating a scenario where EPS could be 2-3x higher than what it is today. In the meantime, even without new states coming on board, the industry is still growing by 20% in the states that have already legalized online casinos.

It’s also worth pointing out that the online casino market could be way bigger than sports betting. Take Pennsylvania: in 2024, online casinos pulled in $2.2 billion in gross gaming revenue, while sports betting raked in just $511 million. This trend is pretty common in other places too, like Ontario, where online casinos dominate with over 80% of the market:

And this is just North America. Management is slowly expanding into new regulated markets, like LATAM (Mexico, Colombia, Peru, Chile, and Brazil), where sports betting and online casinos are taking off.

An additional area of market growth for GAMB is the penetration rate of the US affiliate marketing model. According to management, ~30% of new customers in mature European markets are acquired through affiliate marketing, versus 5% in the US today. As the American market matures and online casinos proliferate, I expect significant affiliate marketing growth to drive user acquisition.

Both of these tailwinds and the upside from Missouri's potential launch as a sports betting state in late 2025 (which is not included in their guidance) give me confidence in management’s ability to execute their long-term plan to reach $100m of EBITDA.

Shrewd Management & an Attractive M&A Playbook

Management has proven itself to be shrewd capital allocators through a very attractive M&A playbook. Historically, they’ve acquired smaller affiliate players and used their know-how to grow traffic and improve monetization. For example, in early 2024, GAMB opportunistically acquired Freebets.com from XLmedia, a dying company, for 5.6x EBITDA. The acquisition was highly successful, which is part of why the company was able to increase guidance consistently through 2024. According to IR, the effective price paid has already dropped under 4x EBITDA.

More recently, in a bid to address some of the past issues affecting the business and grow recurring revenues, management acquired Oddsjam, a technology platform for real-time odds data. The company allows real-time odds information for bettors. Historically, the model was catered to retail clients, but they are now looking to expand into enterprise customers through GAMB’s existing relationships. The business is complementary to its other offerings (specifically rotowire.com) and helps reduce its reliance on operators’ customer acquisition budgets and grow its sports betting segment. Management paid $80m or 6.7x 2024’s ($12m) and 5.5x 2025’s EBITDA for a high-margin, recurring revenue stream. They’ve also structured an additional $80m in contingent consideration if Oddsjam doubles its EBITDA by 2026!

But M&A isn’t their only capital allocation focus. When the stock cratered in early 2024 due to the temporary headwinds I mentioned above, they quickly plowed their cash flow into buybacks, repurchasing $27m worth of stock under $10/share.

Lastly, management has a massive incentive to grow the business. Not only does the CEO own 12% of the company, but he gets compensated 170K option awards for every $500m market cap milestone, up to 2m options if the valuation reaches $5.5b:

The option milestones are governed by very strict provisions (merging won’t help), are not subject to accelerated vesting, are automatically withdrawn if financial statements must be restated, and must be held for another three years after being awarded.

Valuation

The stock currently trades at 12x estimated 2025 EPS ($1.08) and 10x 2026 EPS ($1.35). For 2025, management expects $170-174m in revenue and $67-69m in EBITDA. Oddsjam contributes $29.5m in revenue and $14.5m in EBITDA. So, organically, they are set to grow revenue and EBITDA by about 10% (excluding Missouri). Beyond 2025, the stock should get a boost from Alberta’s upcoming iGaming launch, set to start in early 2026. It also wouldn’t be crazy to believe an additional state or two could legalize iGaming in 2026, setting the stage for material upside to the numbers.

Management aims to reach $100m of EBITDA over the next several years, both organically and through M&A. They could achieve it in 2027, earning me over $2.00 of EPS. At 12x earnings, the stock would be $24.50 or 79% upside from current levels:

As I mentioned above, this business generates close to 100% of its net income in FCF, setting up for over $2 in FCF by 2027 while likely growing double-digit for the rest of the decade.

Risks

Regulatory change is the only constant in gambling, which is partly why gambling companies trade at a discount, in addition to being ‘sin’ stocks. Regulatory changes could include a rollback in iGaming laws, stricter player controls, deposit limits, or tax changes

Google Search policy changes could impact the business once again

Companies employing an M&A playbook are prone to blowups, especially if they lever up

Mark Blandford, an early investor in the company, owns 8m+ shares and has sold stock in the past

Disclaimer: I am not long NASDAQ:GAMB. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

I like the valuation & the rev/EBITDA growth rates. Good tailwinds with increasing online gambling adoption.

Your Risks#2 is my biggest concern: what'll the affiliate marketing industry look like in the world of LLMs. Can someone ask the chatbot "which websites provide the best odds for <poker/baseball/etc>"? Will there need to be a redirection to gambling.com before arriving at the final destination?